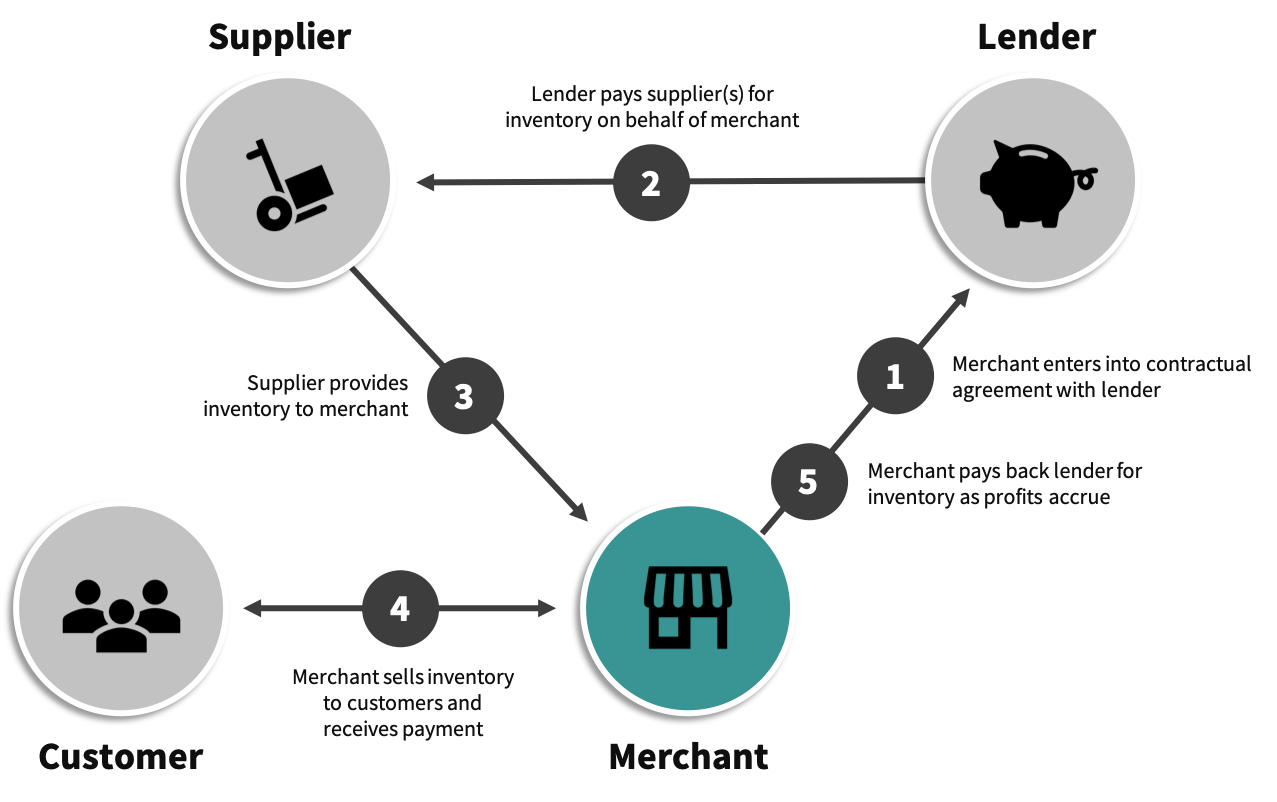

Business inventory finance plays a pivotal role in the smooth functioning of any business. It provides businesses with the financial resources to acquire and maintain inventory, ensuring that they can meet customer demand and optimize their operations.

Inventory financing comes in various forms, each tailored to meet specific business needs. From traditional loans to innovative financing solutions, businesses have a range of options to choose from. This flexibility allows them to customize their financing strategy based on factors such as inventory turnover, cash flow requirements, and risk tolerance.

Benefits of Inventory Financing

Inventory financing provides businesses with several advantages that can enhance their financial position and operational efficiency.

Improved Cash Flow

Inventory financing helps businesses unlock the value of their inventory, converting it into liquid capital. This can significantly improve cash flow, providing businesses with the flexibility to meet their financial obligations, invest in growth initiatives, and seize new opportunities.

Increased Purchasing Power

With inventory financing, businesses can increase their purchasing power by accessing additional funds to purchase more inventory. This allows them to meet increased demand, take advantage of bulk discounts, and negotiate better terms with suppliers.

Reduced Risk, Business inventory finance

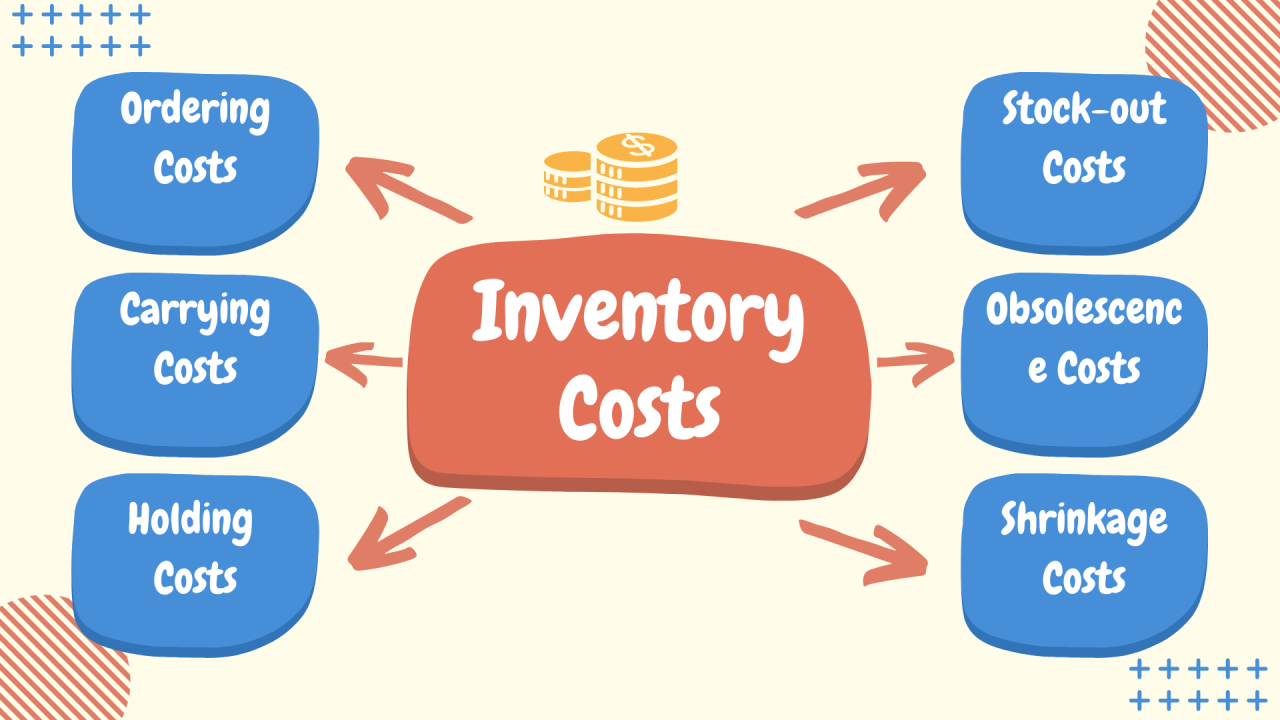

Inventory financing can help businesses reduce the risk associated with holding excess inventory. By financing their inventory, businesses can minimize the potential for losses due to obsolescence, damage, or theft. Additionally, it can reduce the risk of stockouts and ensure uninterrupted operations.

Managing Seasonal Fluctuations

Inventory financing is particularly beneficial for businesses that experience seasonal fluctuations in demand. It provides businesses with the flexibility to adjust their inventory levels accordingly, ensuring they have sufficient stock to meet peak demand without overstocking during off-seasons.

Optimizing Inventory Levels

Inventory financing can help businesses optimize their inventory levels by providing them with the data and insights needed to make informed decisions. By tracking inventory levels and analyzing sales patterns, businesses can determine the optimal amount of inventory to hold, reducing carrying costs and maximizing profitability.

Challenges and Considerations

Inventory financing can present certain challenges and considerations that businesses should be aware of and plan for to ensure effective management and successful outcomes.

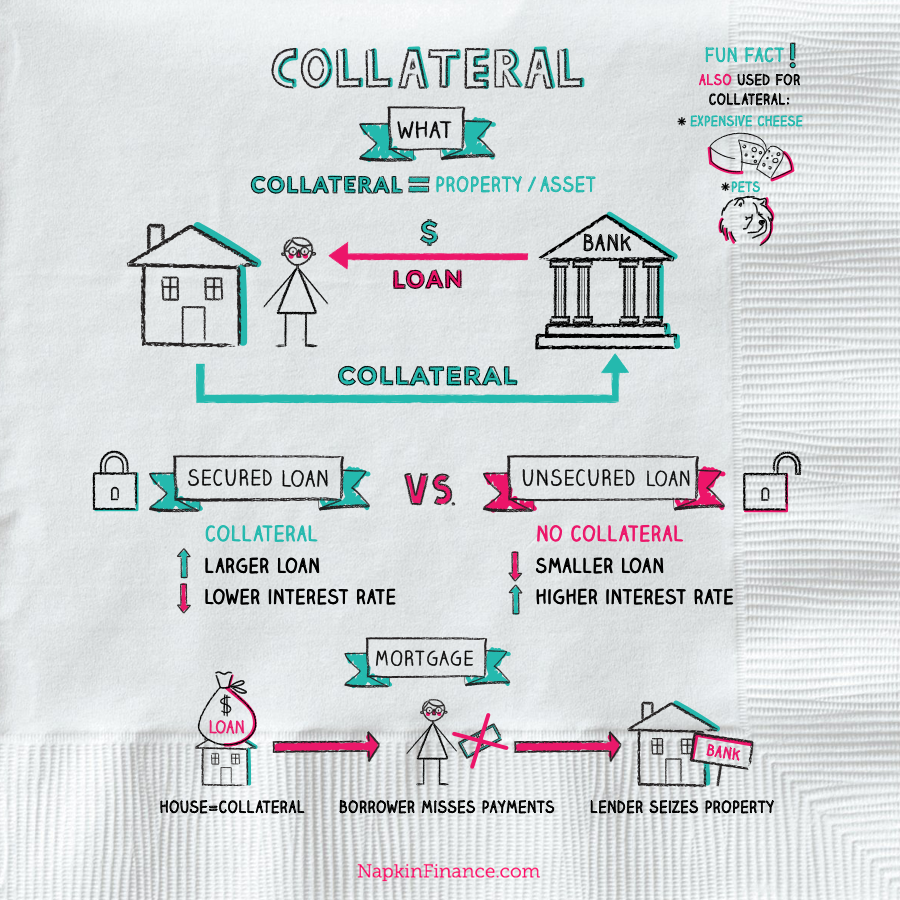

One of the key considerations is the interest rates associated with inventory financing. Higher interest rates can increase the cost of borrowing and impact the profitability of the business. Businesses should carefully evaluate the interest rates offered by different lenders and negotiate the best possible terms.

Repayment Terms

Repayment terms are another important consideration. Inventory financing typically involves short-term loans, and businesses need to ensure they have sufficient cash flow to meet the repayment obligations. Careful planning and forecasting are essential to avoid any potential financial strain.

Inventory Valuation

Inventory valuation is another critical aspect of inventory financing. Lenders will often require businesses to provide accurate and up-to-date inventory valuations as collateral for the loan. Businesses need to establish robust inventory management systems to ensure accurate valuation and avoid any discrepancies or disputes with lenders.

Inventory Financing Options

Inventory financing offers businesses various options to meet their unique needs. Understanding the different types of financing available can help businesses make informed decisions.

Loan Terms, Interest Rates, and Eligibility Criteria

| Financing Option | Loan Terms | Interest Rates | Eligibility Criteria |

|---|---|---|---|

| Line of Credit | Flexible, short-term | Prime rate + margin | Good credit history, sufficient collateral |

| Term Loan | Fixed, long-term | Fixed rate | Strong financial performance, low debt-to-equity ratio |

| Inventory Loan | Secured by inventory | Varies based on risk | Adequate inventory value, good repayment history |

Alternative Inventory Financing Methods

Beyond traditional loan options, businesses can also consider alternative inventory financing methods:

- Factoring:Selling accounts receivable at a discount to a factoring company.

- Inventory Loans:Secured loans backed by the value of inventory.

- Purchase Order Financing:Borrowing against the value of purchase orders.

Case Studies and Examples: Business Inventory Finance

Inventory financing has empowered numerous businesses to overcome challenges, expand their product offerings, and achieve growth. Here are a few notable case studies:

Case Study 1: ABC Manufacturing

ABC Manufacturing, a small-scale manufacturer of custom metal parts, faced cash flow constraints due to the seasonal nature of its business. Inventory financing enabled the company to purchase raw materials and produce inventory in advance, ensuring uninterrupted production during peak demand periods.

This helped ABC Manufacturing meet customer orders on time and avoid lost sales.

Case Study 2: XYZ Retail

XYZ Retail, a growing online retailer, utilized inventory financing to expand its product offerings. The company was able to purchase a wider variety of products and increase its inventory levels, meeting the diverse needs of its customers. Inventory financing provided XYZ Retail with the flexibility to respond quickly to market trends and capitalize on new opportunities.

Case Study 3: DEF Distribution

DEF Distribution, a logistics company, faced challenges in managing its inventory of heavy equipment. Inventory financing allowed the company to acquire and store additional equipment, increasing its capacity and enabling it to meet the growing demand for its services. This investment in inventory led to increased revenue and profitability for DEF Distribution.

Best Practices for Inventory Financing

Effective inventory financing management is crucial for businesses to optimize their working capital and ensure smooth operations. Implementing best practices can help businesses navigate inventory financing challenges and maximize the benefits of this financing option.

Key best practices include:

Inventory Forecasting

Accurate inventory forecasting is essential for determining optimal inventory levels. Businesses should use data analysis, historical sales patterns, and industry trends to predict future demand and avoid overstocking or understocking.

Inventory Valuation Techniques

Appropriate inventory valuation techniques help businesses determine the value of their inventory and manage costs effectively. Common methods include First-In, First-Out (FIFO), Last-In, First-Out (LIFO), and Weighted Average Cost (WAC).

Monitoring Key Performance Indicators

Monitoring key performance indicators (KPIs) related to inventory, such as inventory turnover ratio, days sales outstanding (DSO), and inventory carrying costs, provides insights into inventory efficiency and areas for improvement.

Maintaining Accurate Inventory Records

Accurate inventory records are essential for effective inventory financing. Businesses should implement robust inventory management systems to track inventory levels, monitor stock movements, and prevent discrepancies.

Establishing Clear Inventory Management Policies

Clear inventory management policies define roles, responsibilities, and procedures for inventory management. These policies should Artikel inventory control measures, reorder points, and inventory accounting practices.

Final Conclusion

In conclusion, business inventory finance is a powerful tool that can help businesses unlock their full potential. By providing access to the necessary financial resources, it enables businesses to optimize their inventory levels, improve cash flow, and mitigate risks. As businesses navigate the ever-changing market landscape, inventory financing will continue to play a crucial role in their success and growth.

FAQs

What are the benefits of using business inventory finance?

Inventory financing offers several benefits, including improved cash flow, increased purchasing power, reduced risk, and the ability to manage seasonal fluctuations in demand.

What are the different types of inventory financing options available?

Businesses can choose from various inventory financing options, such as inventory loans, lines of credit, factoring, and purchase order financing. Each option has its own unique terms and conditions, and businesses should carefully consider their specific needs before selecting a financing method.

What are the challenges associated with inventory financing?

Potential challenges include interest rates, repayment terms, and inventory valuation. Businesses should carefully assess these factors and develop strategies to mitigate any risks.